Business Loan & Equipment Leasing Services

-

CLIENT

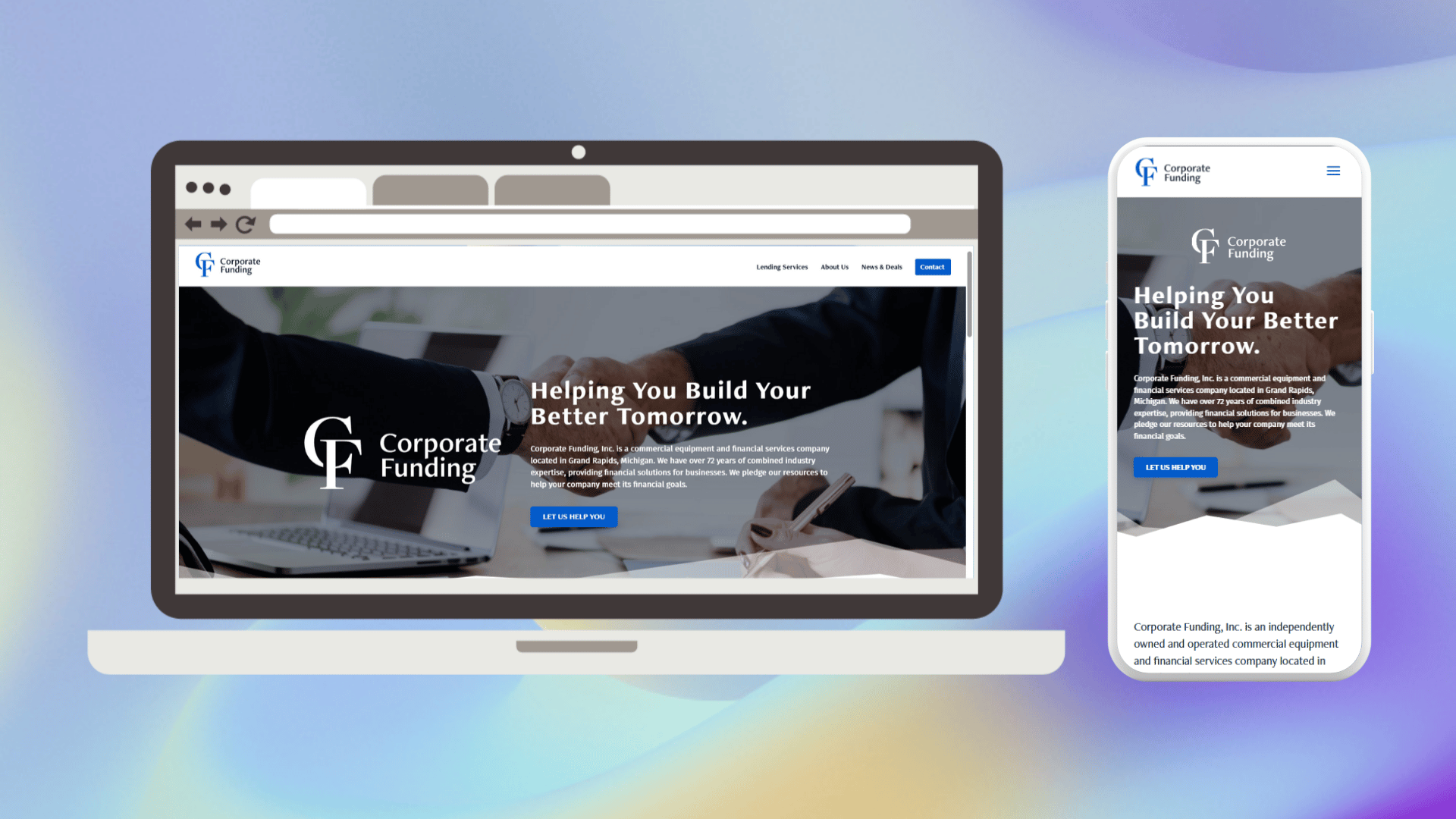

CorporateFunding

-

SERVICES

Web Development

-

DURATION

03 Weeks

-

WEBSITE

https://corporatefundinginc.net