Plugin Overdraft & BaaS Platform

-

CLIENT

Fiinu

-

SERVICES

Web Development

-

DURATION

01 Month

-

WEBSITE

https://fiinu.com

Loading

Fiinu

Web Development

01 Month

https://fiinu.com

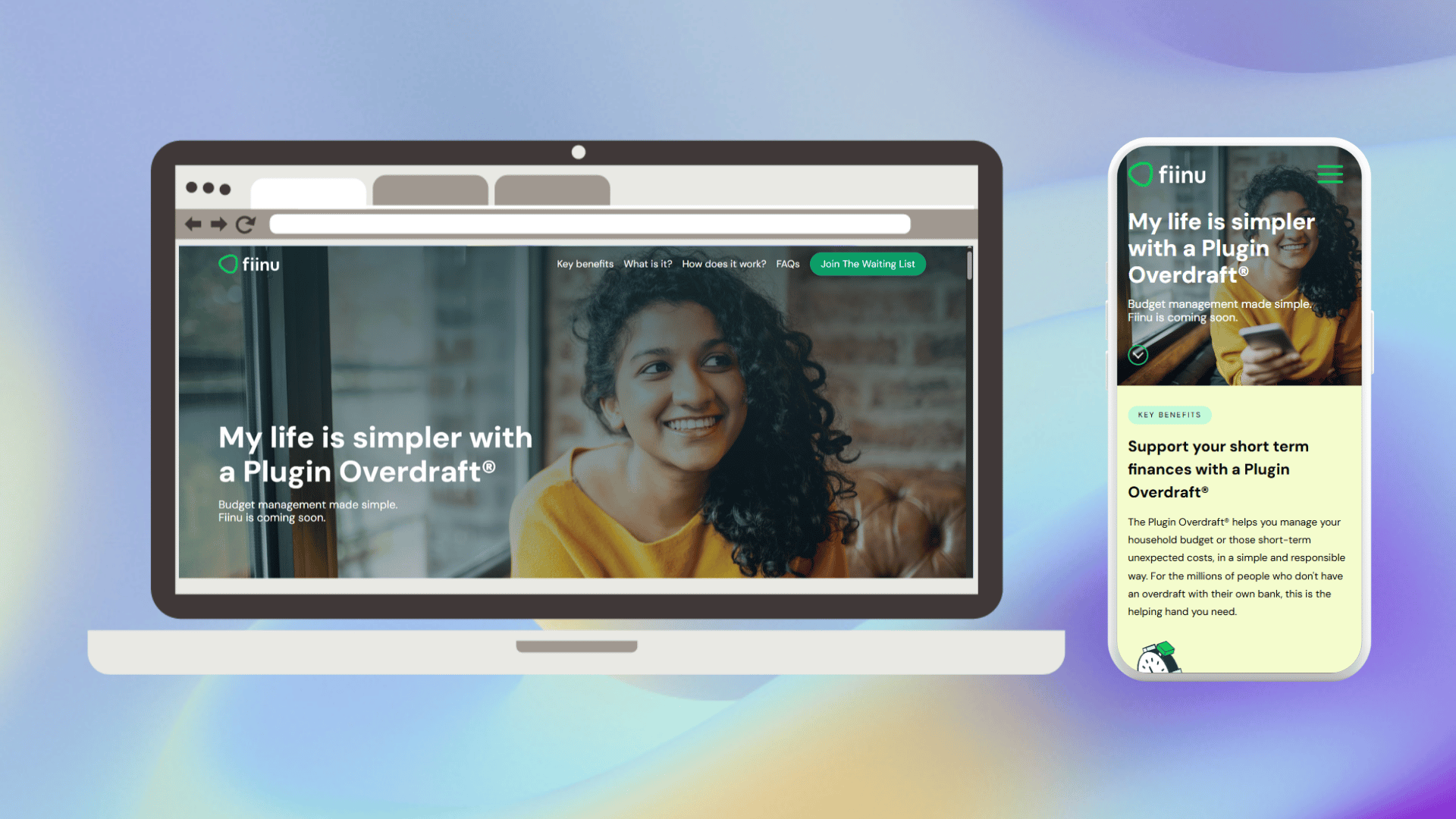

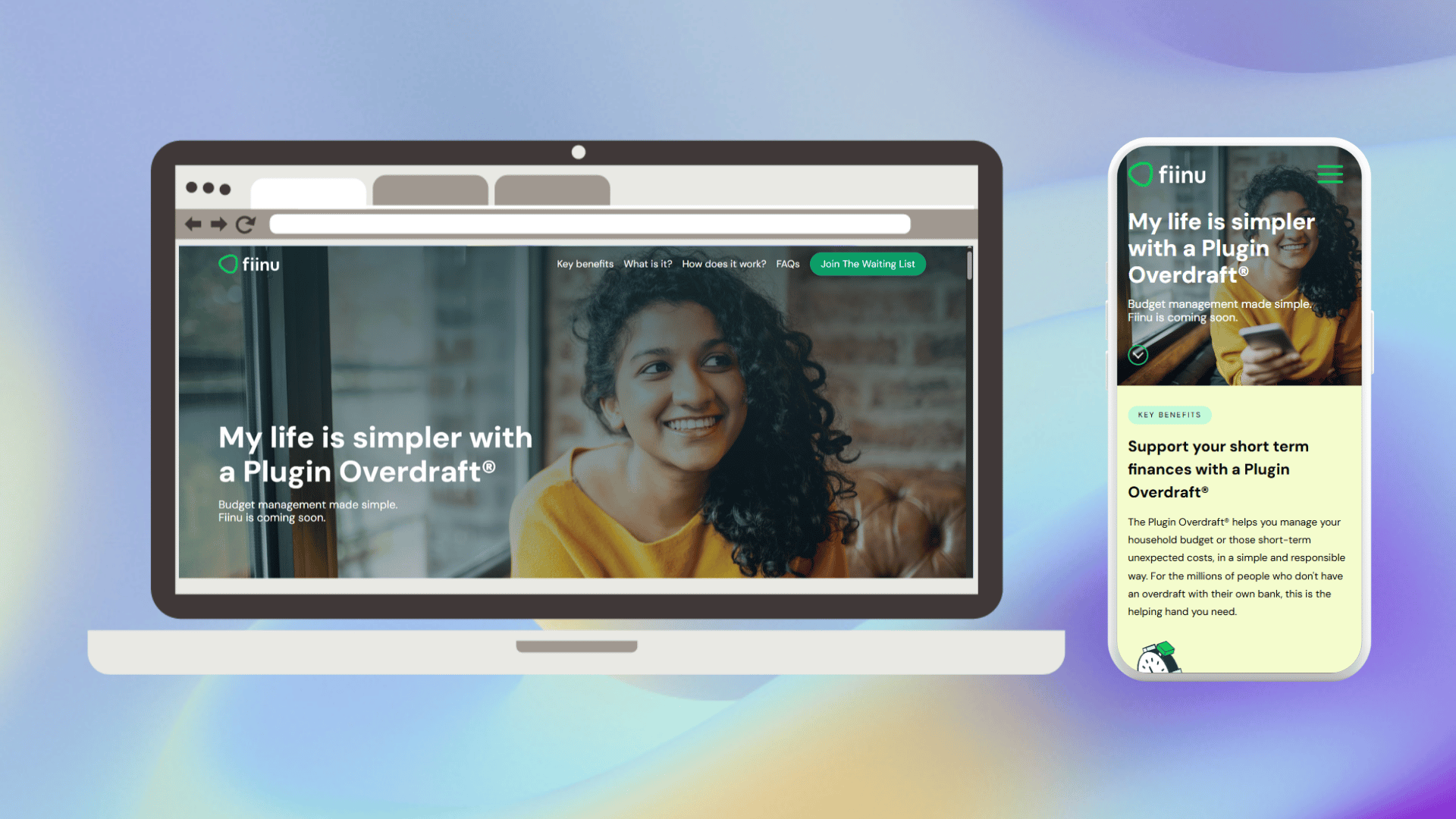

Building Fiinu’s digital presence involved introducing a fundamentally different banking model: delivering short-term overdraft access independent of customers’ existing bank arrangements. The primary challenges included:

Communicating the Plugin Overdraft® concept—which plugs into users’ existing current accounts via open banking, offering amounts between £50–£1,500 with fair interest and no fees—clearly and responsibly.

Positioning Fiinu as both a consumer-facing fintech and a technology licensor, able to white-label overdraft services for banks under compliant regulatory frameworks.

Maintaining clarity during regulatory transitions, securing partnerships, and managing financial instability while updating stakeholders on evolving licensing status and business pivots.

We crafted a dual-purpose platform that balances consumer education, investor visibility, and B2B licensing appeal:

Consumer-Facing Experience: A mobile-first, 3-minute onboarding flow guiding UK users through eligibility checks, open banking linkage, credit offers, and consent-based identity verification. Transparent pricing: simple interest only when the overdraft is used, no hidden fees.

BaaS Positioning for Institutional Buyers: Messaging detailing regulatory compliance (PRA/FCA deposit-taking license), strategic licensing agreements, and technology partnerships—especially with Tuum for API-first, cloud-native core banking infrastructure. This included white-label BaaS licensing deals and royalty structures with UK banks.

Brand & Regulatory Narrative: Strategy to articulate Fiinu’s financial turnaround—from capital constraints to technical reshaping—while maintaining transparency on funding status, banking license maturation, and cost rationalization. Highlights include scaling back costs from £600K to £45K/month and pursuit of tech-licensing pathways amid financial challenges.